A recent study reveals enlightening attitudes toward banking that don’t seem to connect to the realities on the ground. For example, Americans are overwhelmingly bitter toward megabanks, and truly understand the importance of banking locally. Yet, they don’t actually do so. Further research reveals a cause for this gap: 73% of adults say a recognizable brand name is important when choosing where they bank. In other words, the consistent presence of a recognizable brand has a powerful influence in consumer decision making.

The Consumer Banking Insights Study (conducted December 2013) shows that, consumers often choose the most recognizable brand name in banking, even when they don’t feel they will be treated well by that institution. In short, the constant air-cover provided by mega brands, combined with their broad network of branches and online/mobile access points, convinces consumers that it is ok to be just a number.

In this environment, it is imperative that community financial institutions be able to consistently promote a brand with national appeal that can attract consumers as they look to change banking relationships. Which is where Kasasa — a breakthrough national brand of consumer banking products offered through community banks and credit unions — comes into play.

Banking Data Confirms Report

The findings in this study are strongly reinforced by on-the-ground performance data for BancVue’s white-label reward checking products versus the nationally branded Kasasa version of these same products.

But we’ll get to that later, first, consider these incongruities:

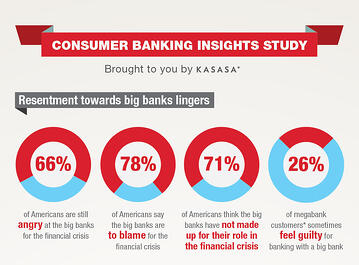

- Five years later after the financial crisis of 2008:

- 78% of Americans say the big banks are to blame for the crisis

- 66% are still angry at those banks

- 71% think the big banks have not made up for their role in the crisis

- Less than half (42%) of megabank customers believe their bank has

their best interest at heart (versus 79% for consumers banking with a community institution)

their best interest at heart (versus 79% for consumers banking with a community institution) - 78% of Americans believe there’s importance to banking locally

- 81% report being at least somewhat knowledgeable about the impact of banking locally on their community’s economy

And yet…megabanks hold more than 70% of the nation’s deposits.

A Brand Name Is Needed To Bridge The Gap

The silver lining comes from knowing there’s a solution to this puzzle. The same people in the study reveal these facts:

- 73% of adults say a recognizable brand name is important when choosing a bank

- That number jumps to 81% among Gen Y

- 63% of megabank customers have never even considered opening an account at a community bank or credit union

The Solution: Community Institutions With Brand Name Products

Since 2004 BancVue has provided reward accounts, which credit unions and community banks offer with whatever product name they choose. BancVue launched Kasasa in 2009, a nationally branded version of those reward accounts. Consider these results:1

- Generic reward checking results in an average 20% lift in account acquisition

- Launching Kasasa results in an average 50% lift in account acquisition

- An institution converting their existing generic reward checking to Kasasa enjoys a 65% lift in new accounts!

It is important to note that Kasasa accounts work exactly the same as unbranded rewards accounts or those that are marketed by an individual community bank without the support of a national brand. The difference is the world-class marketing and inherent power of a recognizable brand name that Kasasa brings.

Capitalizing On The Growth

Attracting new relationships is excellent, but it gets even better when you realize the profitable behaviors of Kasasa-minded consumers:

- Generate a 45% lift in non-interest income1

- 2X greater annual profit-per account1

- 2X more likely to take a loan2

You can read more about the inherent profitability of Kasasa accounts in the white paper, “Finding The Silver Bullet For Margin Compression.”

But the bottom line is this: most Americans would prefer to bank with a community bank or credit union. But, those community institutions are out-shouted by the consistent branding of mega-banks. There is no perfect answer because banking competition is formidable, but having a nationally recognized brand name product clearly helps Americans act on their desire to bank with a local institution.

Unless otherwise noted, all stats from the Consumer Banking Insights Study,” conducted December 2013 by Harris Poll.

1BancVue Analytics, utilizing data from hundreds of community financial institutions nationwide.

2The Raddon Report, “What’s the Reward for High-Rate Checking?,” October 2009