In a COVID-19 world, consumers are still on the hunt for houses. Many people are eager to finance or refinance their home after the Fed dropped rates in response to the pandemic. In May of this year, homebuying demand was 5.5% higher than it was pre-pandemic.

With homebuying not slowing down anytime soon, now is the time for community financial institutions to win their share of business by understanding how consumers shop for homes. We turned to Google and Moz, a search engine optimization consulting firm, to answer that question. Below is an analysis of the steps consumers take based on the volume of searches they make.

Should I even buy a home?

The first questions people ask themselves indicate they're wondering if buying a home is even a good idea. We see questions such as:

-

Is it smarter to rent or buy?

-

Is it a good time to buy a house?

-

When is the best time to buy a house?

Those queries tell us that what consumers are really seeking is confidence: They want to know whether they are making the smartest financial choice. This is especially true for Millennials, who had their confidence rattled by the 2008 recession during their formative years.

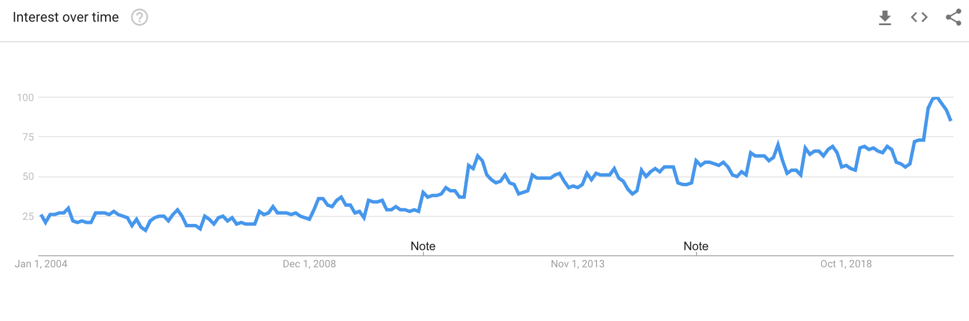

People are looking for expert analysis on the current market, local price trends, and the financial benefits of buying a home, such as building equity and receiving tax benefits. Using Google Trends, we can see that these kinds of searches peak around January and July. Interest in mortgage-related topics drops from August through December.

Community banks and credit unions can meet this demand by increasing their blog content, social media posting, and paid advertisements during January and July.

Should I refinance my home?

After the Fed dropped rates this year, home refinance searches saw a whopping 8.3x year-over-year increase in March, according to Google Trends.

What’s interesting is that one in five of the home refinances that took place in the first quarter of 2020 were by first-time homebuyers (or first-time refinance borrowers). And home ownership for Millennials was at 37.3% during this time, an increase of two percentage points from the same time period 2019.

With rates staying low through the summer and possibly through the fall, refinances are expected to continue rising. Tailoring your digital marketing to first-time refinancers and offering educational tools can be a great way to win over this audience and add new mortgages to your portfolio.

Figuring out a budget

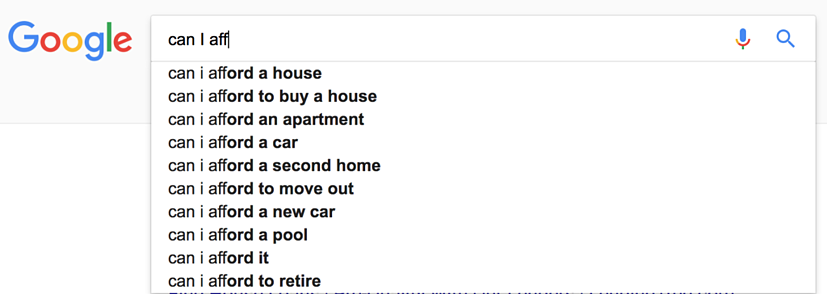

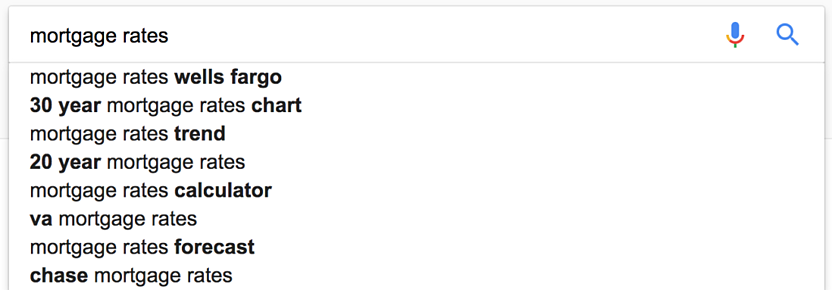

Going back to people who are in the market to buy, once a consumer feels confident in their choice to explore buying a house, they begin to wonder how far their money will get them. We can see evidence of this looking at Google's recommended searches...

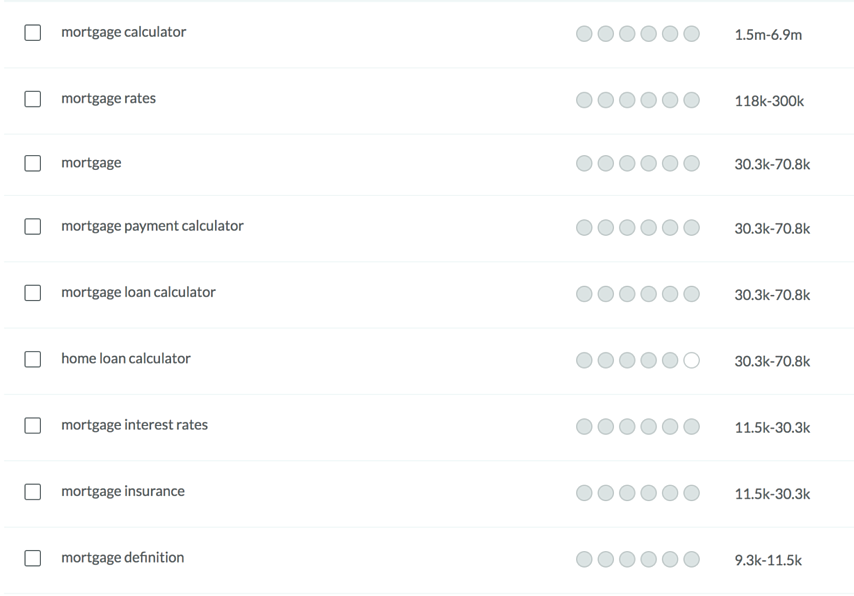

...and by looking at the top keyword searches by volume. Notice how mortgage calculators feature prominently in the following results. This suggests that people are worried less about the total cost and more about what they could afford with a comfortable monthly payment.

Most consumers think less about the long-term cost and more about the impact home ownership will have on their current cash flow. It's part of the reason most of us are so bad at saving for retirement. Because they're more concerned with present-day cash availability rather than long-term cost, consumers are often seeking the maximum amount of house they can purchase with a monthly payment that they can afford. Calculators are great at answering this type of question because they allow the consumer to play with multiple variables (like interest rate, purchase amount, and payment) and see how the results change.

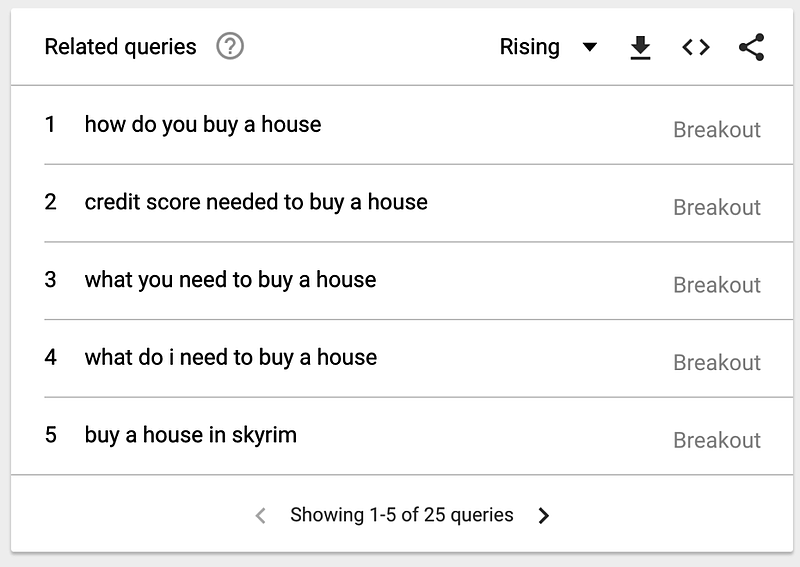

As consumers work to pin down their budget, they will likely have other questions. Again, we can see some of these by looking at breakout queries in Google Trends.

Other common questions are:

-

What is PMI?

-

How much should I put down?

-

Can I buy a house with bad credit?

-

What are the hidden costs of buying a house?

This presents financial institutions with an incredible opportunity to make helpful content for their consumers.

Finding the right house

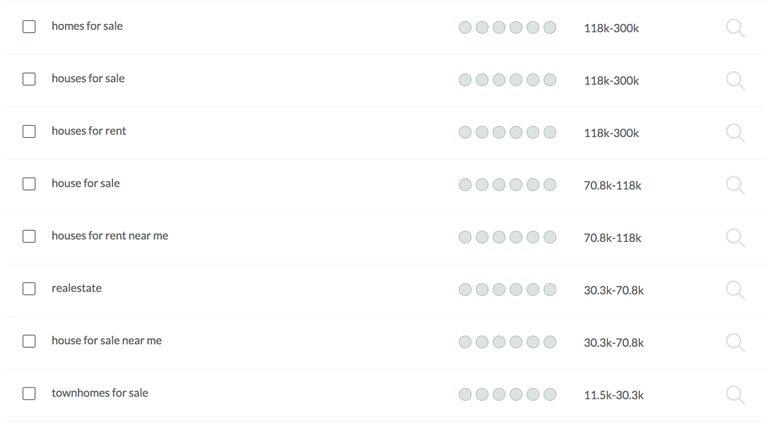

Now comes the fun part. Once consumers feel like they have a handle on the financial aspect, they begin to search for houses in the area that meet their criteria. This is a screenshot for keywords associated with searching for a home as pulled from Moz. You'll notice that the volume of search here is much lower than at the previous stage, indicating that some people dropped.

When searching for a new house, consumers often add "near me" to the end of their query. For example, "townhomes near me" or "condos for sale near me." Another variation of that search is to add the zip code: "houses for sale 77007."

And in March 2020, the search volume for “mortgage near me” saw a 2.1x year-over-year increase.

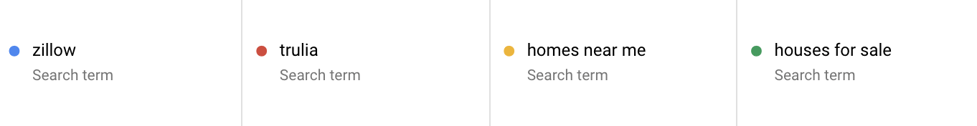

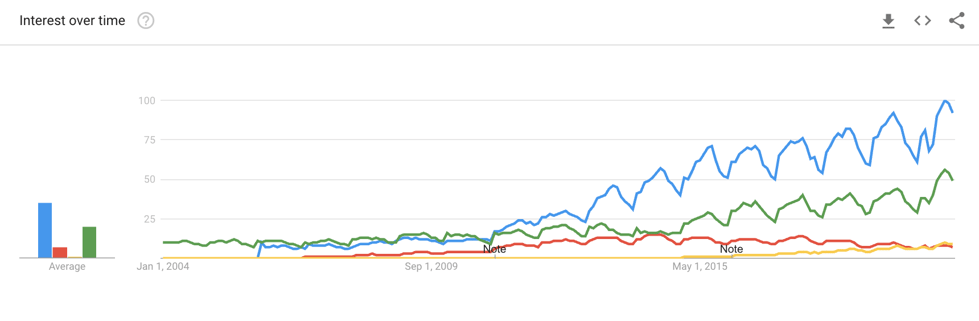

It's important to note that most of this step is done on 3rd party platforms like Zillow or Trulia. According to Zillow, 80% of first-time homebuyers use their platform. In this Google Trends screenshot of the Real Estate category, we can see that searches of those two apps have been trending upwards and Zillow is the preferred search platform.

Google also features these platforms prominently in their search results.

Most of these platforms allow consumers to begin finding a lender within the platform. Knowing that such a high volume of shoppers use these 3rd parties, institutions that want to compete should be sure that (1) they are listed and (2) they have a positive review. For more information, check out Zillow's and Trulia's lender guides.

There might be questions that pop up at this stage of the process, like "How do I buy a house in foreclosure?" or "How do I buy a house at auction?"

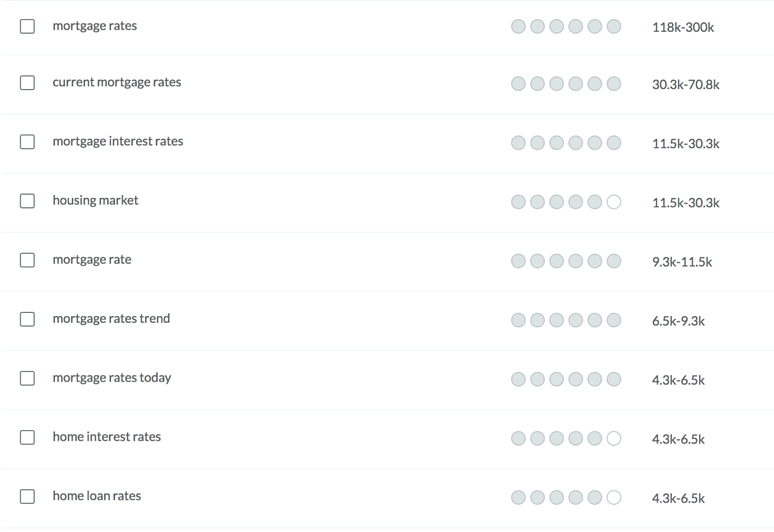

Shopping for the best loan

Consumers have finally found the house of their dreams... or close enough to it that now they begin to search for financing. As we've already mentioned, a large chunk of those prospects will search through Zillow or Trulia for their financing. The remaining chunk will head back to Google to comparison shop. Again, we can see a big drop off in search volume at this stage of the funnel.

A word of caution: At this stage of the funnel, we begin to see a lot of branded searches. Consumers start to search for mortgages at specific institutions, which means your odds of winning their business is much lower. This puts added importance on effectively marketing in the previous stages.

Education around mortgage terms

Once consumers get further into the mortgage process, they'll begin to realize that the process and options can be a little complicated. Consider this your second chance to earn their business. Some common terms consumers will need help understanding are:

-

Conventional Mortgage

-

Mortgage Insurance

-

FHA Mortgage

-

VA Loan

-

USDA Rural Housing Loan

-

Adjustable Rate Mortgage

-

Fixed Rate Mortgage

-

PITI

-

Points

-

Home refinancing

At this point, consumers have typically begun working with a specific institution. Even if you haven't won their business, there are still plenty of opportunities to attract them. Consider building content around home ownership and position yourself as the go-to when they seek a HELOC or home improvement loan.