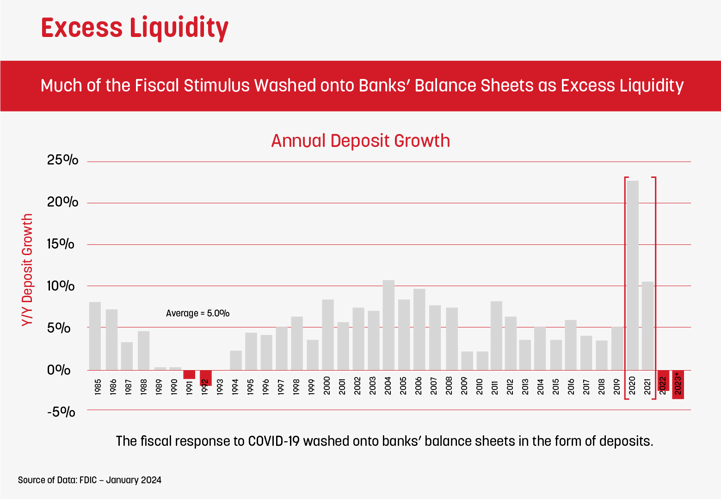

Since the Great Recession, the monetary policy of the Fed has allowed financial institutions to keep their cost of funds at varying shades of “free” — with its major peak coming on the heels of $5 trillion in pandemic stimulus. With nearly $1.4 trillion in deposits leaving the banking system in 2023, deposits are the most scarce they’ve been in over a decade. This has created a serious wake-up call for the industry.

Growing deposits and managing ever-increasing cost of funds is a major issue for community banks and credit unions with 7 out of 10 industry executives citing it as a top concern in a recent survey. Combine that with the fact that nearly half of consumer checking accounts are opened at fintechs now, and the stage is set for an all-out war for consumer deposits.

Imagine this from the perspective of a CEO of a local community bank or credit union who has $1 billion in assets vs. the $3.2 trillion of a major megabank. Community banks have always succeeded by having a deep connection to their community, but now everyone just starts online. Consumers used to go to the branch to see what products were available. Now the competitive market is not defined by county lines, but by what a consumer finds when they search on Google.

Winning under conditions like that is admittedly tough. But smart, local banks and credit unions have incredible conditions to win in 2024 if they leverage their strengths.

Community banks and credit unions are preferred by consumers, right?

Since 2008, we’ve measured consumer sentiment regarding community banks and credit unions. Year after year, about 2/3 of consumers classify smaller, local institutions as “having their best interest at heart” versus fintech and megabank alternatives.

People have overwhelmingly positive sentiments regarding local institutions, but market share trends show that consumers’ actions don’t match the sentiment. Over the last 25 years, local institution market share has plummeted from the mid-70%s to around 20% (FDIC, NCUA).

It’s like all of America has seen the movie “It’s a Wonderful Life” and loves local banker George Bailey, but nobody wants to bank at Bailey Building and Loan anymore. So why aren’t consumers banking where they say they’d prefer? One of the biggest reasons, according to internal Kasasa research: 72% of consumers say they don’t believe the products (particularly the digital banking experience) of a community financial institution will be as good as what they expect from a megabank or fintech. And this has truly been a gap for most local institutions for decades. But the pandemic changed that.

Necessity became the mother of digitalization.

COVID lockdowns forced an immediate shift from brick and-mortar to serving customers’ financial needs 100% remotely. Many community financial institutions felt the pain of dated digital banking systems. What resulted was a true digital transformation of the industry. Desperate to serve their consumers in the new remote reality, thousands of small banks and credit unions invested billions of dollars in new technology. Today, finding a local institution that offers a contemporary banking experience with the same elegance of slick fintech is easy.

Powered up by new technology, these local institutions can also take advantage of regulatory and structural differences to pay consumers significantly better rates and rewards. Since 2010, with the passage of the Durbin Amendment, financial institutions with less than $10 billion in assets are allowed to generate significantly more income from debit card purchase volume than larger institutions. This disparity in interchange revenue, combined with other market factors and the fact that credit unions don’t pay income tax, means that small institutions can profitably pay richer rewards to consumers.

Superior rates lead to superior growth.

Nowhere is this more obvious than in interest rates. Thousands of local institutions offer high-yield free checking — many with rates in the 5-6% range compared to the nationwide average of 0.57% for savings. Typically, these accounts pay the high rate of interest when the consumer meets monthly qualification criteria that indicate the consumer is using the local bank or credit union as their primary financial institution (i.e. using their debit card 10 times a month, logging into online/mobile banking once, etc.).

In an internal study of 75 local institutions that set high-yield checking as their highest rate product in 2023, those institutions grew deposits by 4.11% while the market shrank by 0.56%. Surprisingly, the cost of funds at those institutions went up 30% less than the average over the same period. At a time when growing deposits and managing cost of funds is top of mind, this is a huge advantage for small institutions. And because this type of account benefits greatly from the improved debit card revenue enjoyed by <$10B institutions, it’s a strategy the big banks won’t choose to copy.

With solid technology and the conditions to offer superior rates, why wouldn’t a consumer choose George Bailey now? “It’s a Wonderful Life” is an old movie, but the values are alive and well in thousands of local institutions nationwide.

When the same people that hold your deposits, live in and love the same community that you do, when service isn’t measured on a scale of 1-5 rating your call center experience, but rather by how you were supported in a time of real need or opportunity, the result is something different in kind.