Whether you’re utilizing mobile payments, digital wallets, or even just checking your balance, you need to follow these mobile banking security tips.

You love the convenience of mobile money apps, but how much of your information is actually protected? Mobile and online security remain hot topics due to news of data breaches, and each new report reminds you to take mobile safety into your own hands. One thing is for certain: you can never be too safe, especially when you use cellular data away from known WiFi systems, such as your home or office.

So, what are users to do in a digital world? While there’s plenty of reasons you should feel comfortable utilizing mobile banking apps due to their higher levels of security, such as multi-factor authentication, or MFA, you need to know the best practices. Whether you’re utilizing mobile payments, digital wallets, or even just checking your balance, you need to follow these mobile banking security tips.

1. Check and change your password

Your first line of security is your online password. Many people mistakenly use a password that’s not as secure as you'd think. Using personal information like your birthday or a pet's name might be easy to remember, but it’s also a recipe for disaster; Many people know that information or it is easy to find just by looking at someone's social media profile. Avoid using any of the following as a password:

-

Pet’s name

-

Child or spouse's name

-

Mother's maiden name

-

Birthdays or Anniversaries

-

Phone number digits

-

Easy pin numbers (like 1111)

-

Common computer phrases like 'qwerty' or 'password'

-

Name of your past schools

-

The same password as your email or social media accounts

A strong password will be an unusual mix of words, special characters, and numbers. Get into the habit of changing your password regularly, at least every two months. Many services even allow you to double secure your account with two-factor authentication. This might mean you enter both a password and a pin number or that you have to type a code texted to you. This extra step is a smart idea whenever it is offered from a site that contains your personal or financial information.

Finally, make sure you password-protect your mobile device. If your phone is ever misplaced or stolen, you don’t want to make it easy for them to access your information. Choose a code that isn’t easy to guess, preferably a random collection of numbers.

2. Beware of phishing

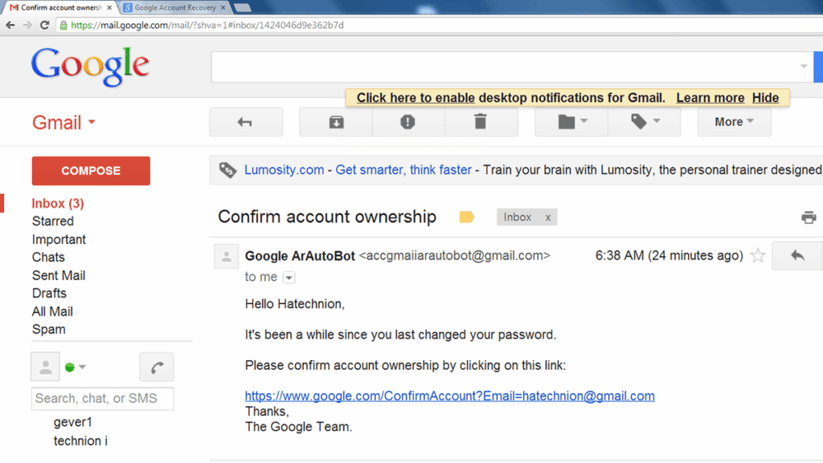

Have you ever received a spammy looking text message or email? If so, you’re not alone. In fact, phishing and social engineering is the most common method used to compromise personal information. Sometimes it’s easy to spot a phishing scam, but other times it can look like a legitimate email from a friend, employer, or service provider. If you receive a message from someone you don’t know, or something seems to be off, don’t click any links.

This most often happens via email, and they can sometimes appear to be from legit companies that you frequently access. These phishing attempts will typically create a sense of urgency by either pretending that you've won a prize, a friend is having an emergency, or there is an issue with your account. Before you rush to provide your account information, check if it’s a phishing scam. Check for the following;

-

Is this a legitimate website?

-

Do you recognize the sender?

-

Does the email come from the correct domain name?

-

Are there any grammatical or spelling errors?

-

When you hover over the link, does it go to where you expect?

Remember that no company will ever ask you to share personal information through an email, and they won’t ask you to reset your password through a link.

If you're in doubt, go to the website of the company that supposedly sent the email and reach out to them to confirm the issue.

3. Pay attention to your location

Keep your device close to you at all times. It’s easy for someone to quickly snatch it while you’re in public, so never let it out of your sight even for a moment. Beware of where you’re located when using mobile banking apps. Depositing on the go is convenient, but it’s not always safe. People can see your sensitive information just by looking over your shoulder as you deposit a check in a coffee shop, for instance.

Similarly, when you’re reviewing a business or personal invoice, credit card or account statements, even your purchase history from a mobile retailer, make sure you’re familiar with the best practices for your security. Pay attention to your location and who is around you. It’s easy for prying eyes to peek at your invoice or banking information if you’re utilizing mobile banking in a public place, especially if the location has cameras for security (the business' security, not your data's). When possible, save all banking activity for when you’re at home and you don’t have to worry about anyone peeking at your password information.

If possible, avoid using public WiFi. These networks are more open and are much more susceptible. Hackers could be monitoring activity and stealing your information.

4. Secure your device

Finally, you need to make sure your devices are secure when utilizing any form of online or mobile banking. Install an anti-malware software on your home computer, and make sure your wireless connection is secure. You don’t want strangers able to utilize your wireless network since this gives them access to your private information.

When using your mobile phone, make sure you check your mobile app permissions often. These apps can sometimes access information in the background, and you never want to leave yourself open to data sharing. A final step is to make sure you have a remote wiping option in case something goes wrong. For example, with iPhones you can remotely clean your device via Find My device, and this can protect your information if your phone gets into the wrong hands.

5. Use your bank or credit union's app

One of the most secure ways to do your mobile banking is through your financial institution's official mobile app. While you maybe be able to have similar functionality through a web browser, the app will provide an extra level of encryption. It often times will offer you a better user experience specifically designed for smaller screens.

While companies push to create more secure options for their customers, consumers need to take responsibility for security on our mobile devices, as well as online. There are so many ways for your data, especially financial data spread across multiple apps, to end up in the wrong hands when you’re using your smartphone.

Make sure you aren’t compromising the safety of your checking or savings account when you access your information digitally. Being safe with your data is worth the extra effort.